It’s at this time of year that I thought it was a tradition for the British people to head out to the Real Estate Agents and start bidding up the prices of already over priced housing. This summer though it’s starting to look like that might not happen. Even the new coalition government don’t seem keen to ramp up property and property prices. Of course they are acknowledging that the country no longer has any money however the previous government seemed to always find some way to ramp prices and keep the plates balanced and spinning. This month has seen both prices and mortgage approvals turn down. Who knows if this continues for a couple of years maybe we might even get to the point where instead of the government forcing builders to build “affordable housing” (or as I have eloquently seen these properties referred to elsewhere, slave boxes) instead maybe we might just get housing that is affordable. What a novel idea.

Pages

▼

Saturday, 31 July 2010

Sunday, 25 July 2010

Government supports the banks ripping off the average saver – NS&I Index Linked Savings Certificates suspended

I’m sure by now that most readers will be aware that this week National Savings & Investments closed for sale its RPI+1% index linked savings certificates (ILSC’s). If they stay closed for a long time or even reopen in a few months linked to the CPI instead of RPI its going to give me and I’m assuming many others a few problems. My retirement investing strategy uses NS&I ILSC’s extensively. I currently have 20.7% of my net worth ties up in them.

Wednesday, 21 July 2010

Positive real savings rates are impossible to find - Average UK savings interest rates – July 2010 Update

If you’re a UK saver it remains pretty ugly out there. According to Money saving Expert the top clean rate account pays 2.6% AER however it allows only one penalty free withdrawal a year. That doesn’t sound overly clean to me. If you want unlimited access then you’re looking at 2.5%. With the RPI at 5.0% today, every month you hold your money in one of these accounts you are seeing its purchasing ability eroded.

Tuesday, 20 July 2010

The Real Pay Cuts Begin – Average UK Earnings – July 2010 Update

My first chart today shows that as of April 2010 the non seasonally adjusted average earnings index (LNMM) year on year rising by 0.5% and the seasonally adjusted average earnings index (LNMQ) rising by 1.9%. This all sounds great until you look at the inflation figure also shown on the chart which in April 2010 was year on year increasing at 5.3% and today is still increasing at 5.0%.

Monday, 19 July 2010

It will always be inflation – UK Inflation – May 2010 Update

I am still reading on blogs and in news articles many discussions on whether going forward we will see inflation or deflation. I might as well wade into the debate and suggest that over the long term (remember I’m a long term investor not a short term trader) I believe that we will see inflation. We could even see hyper inflation. What makes me say this? Well, my first chart showing the UK RPI for starters. It has never failed to reach a new high meaning inflation. Sure we’ve seen some deflation over the short term however I believe that policy makers and governments will just not tolerate deflation as it makes debts larger and savings worth more. Given the debts of governments and individuals this cannot be tolerated. Inflation is the easy way out. I believe that as soon as deflation next appears we’ll see yet more quantitative easing or other drastic measures to try and secure inflation. If they can’t engineer the inflation quickly through moderate means they will continue taking more risks shamelessly until the risk of currency destruction through hyper inflation is upon us. That sound pretty extreme but it is what I feel today.

Sunday, 18 July 2010

Houses are still overvalued - UK property market – July 2010 Update

The Economist dated July 10th to 16th 2010 has run a very interesting article entitled “Froth and stagnation – House prices in parts of Asia continue to soar, despite efforts to slow them”. As part of this article they present a table showing a list of countries and detail whether according to “The economist house price indicators” houses are under or overvalued. As regular readers will know I am very interested in UK and Australian house prices however let’s have a look at the list from most over valued to most undervalued first:

Saturday, 17 July 2010

Gold Priced in British Pounds (GBP) – July 2010 Update

In real (inflation adjusted) terms gold has stopped, at least temporarily, its steep climb by falling in value by 6.1% month on month (£837.28 to £786.14). Year on year though gold is still up by 30.8%.

Gold when priced in British Pounds (GBP) is however still yet to reach new real highs. Since 1979 we have seen two month average higher real (inflation adjusted) peaks. The first was £867.22 in 1983 and the second was £1,076.06 back in 1980. These peaks are still 9.4% and 26.9% higher respectively than today’s price.

Gold when priced in British Pounds (GBP) is however still yet to reach new real highs. Since 1979 we have seen two month average higher real (inflation adjusted) peaks. The first was £867.22 in 1983 and the second was £1,076.06 back in 1980. These peaks are still 9.4% and 26.9% higher respectively than today’s price.

Thursday, 15 July 2010

Gold Priced in US Dollars (USD) – July 2010 Update

Within my Retirement Investing Strategy I currently hold 5.4% (down from 5.5% at the last USD gold update) of my portfolio in gold with a targeted holding of 5%. This is a variation from target of only 7% which is relatively small meaning I will not rebalance. Remember also that Gold is the only portion of my portfolio that does not provide a yield (dividends, interest etc). Even though it doesn’t provide a yield and some would even call it a ‘barbarous relic’ I choose to hold it because of its negative correlation with stocks. While one is zigging hopefully the other is zagging meaning I am selling one high while buying the other low. Only time will tell if this strategy will work.

Sunday, 11 July 2010

UK FTSE 100 CAPE or FTSE PE10 based on the Shiller cyclically adjusted price earnings ratio model

Update 13 July 2010: Chart 3 added following UKVI's comment below.

For many months now I have been showing the PE10 for the ASX200 and the S&P500 however what I have always been looking for is a cyclically adjusted PE ratio dataset for the UK FTSE100. In shorthand a FTSE100 CAPE or FTSE100 PE10 depending on your preference for acronyms. Unfortunately a complete dataset has been impossible to find. I have therefore spent many hours constructing one from pieces of data taken from Motley Fool Discussion Boards, the Financial Times marketdata and Yahoo Finance. I therefore can for the first time present a chart of the FTSE100 PE10 and for good measure I’ll throw in the Real (inflation adjusted) FTSE100.

For many months now I have been showing the PE10 for the ASX200 and the S&P500 however what I have always been looking for is a cyclically adjusted PE ratio dataset for the UK FTSE100. In shorthand a FTSE100 CAPE or FTSE100 PE10 depending on your preference for acronyms. Unfortunately a complete dataset has been impossible to find. I have therefore spent many hours constructing one from pieces of data taken from Motley Fool Discussion Boards, the Financial Times marketdata and Yahoo Finance. I therefore can for the first time present a chart of the FTSE100 PE10 and for good measure I’ll throw in the Real (inflation adjusted) FTSE100.

Saturday, 10 July 2010

UK Mortgage Rates and Mortgage Approvals – July 2010 Update

Today I present two regular charts that could provide an indication of what is happening in the housing market. The first shows the monthly interest rate of UK resident banks and building societies sterling standard variable rate mortgage to households (not seasonally adjusted) and highlights that for this data set rates remain at near record lows at 3.92% for May 2010 (actual low was 3.82% in April 2009). Compare this with the retail price index (RPI) of 5.1% and the average mortgage is better than free money with a negative real interest rate. Month on month the rate has fallen by 1.8% and year on year the rate has risen by only 2.4%. I’d call both of these changes flat which is obvious by looking at the chart.

Thursday, 8 July 2010

The Non Event - Bank of England holds the UK Bank Rate at 0.5% - July 2010 Update

Wednesday, 7 July 2010

My Retirement Investing Today Current Low Charge Portfolio – July 2010

I first started taking my retirement investing asset strategy seriously in 2007 when I became disillusioned with the financial sector and decided to go it alone. While I made a start in 2007 the majority of the time was spent reading about personal finance and it wasn’t until 2008 that I really started to formulate the strategy that you see today. The strategy could be called extreme. I aim to save on average 60% of my after tax earnings and pension salary sacrifices. Following this strategy has me currently forecasting retirement in 6 years. This monthly entry calls me to account and forces me to assess if I am still on track and to determine if all the effort is worth it or whether I would be better off with a simple bond/equity asset allocation that is rebalanced yearly. What I call the Benchmark.

Tuesday, 6 July 2010

A History of Severe Real S&P 500 Stock Bear Markets – June 2010 Update

I first started posting today’s charts back in January 2010. I ended that post with “My question is once the governments of the world are forced to stop stimulating the economies through borrowing (for example a bond market strike) or quantitative easing (for example excessive inflation) could we yet see that real -60% bear? History suggests there is still plenty of time for it to occur.” Well that day could be now be upon us. We know that many countries out there are today all but ‘bankrupt’ or in the very least are now talking about and implementing austerity measures. So that writes off stimulation via borrowing at least for the moment. I assume that some countries out there would have another go at borrowing if they really needed to although it would be interesting to see what sort of treatment the bond markets would give them this time around?

Monday, 5 July 2010

US (S&P 500) stock market including the cyclically adjusted price earnings ratio (PE10 or CAPE) – June 2010 Update

To try and squeeze some more performance out of a retirement investing strategy that is heavily focused on buy & hold and asset allocation I am using a Cyclically Adjusted Price / Average 10 Year Earnings (PE10 or CAPE) ratio for the S&P 500 to value the US (specifically the S&P 500) stock market. The method used is that developed by Yale Professor Robert Shiller however I also incorporate earnings estimates up to the PE10 month of interest. Background information here.

Sunday, 4 July 2010

Buying Australian Equity Index Tracker (ASX200)

As I’m sure everyone knows the Australian Stock has seen some falls of recent weeks. Using my monthly data set it’s down 13% from the monthly peak of 4876 in March 2010. Of course it’s still well above the monthly low of 3345 in February 2009 by some 27%. These falls have meant that my target asset allocation of ASX200 equities within my Low Charge Portfolio has risen to 20.9% and my actual has fallen to 17.0%. If you’re not sure about how I built my asset allocation and particularly how I use tactical allocations then please read here and here.

Saturday, 3 July 2010

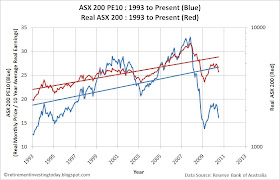

Australian (ASX 200) stock market including the cyclically adjusted price earnings ratio (PE10 or CAPE) – June 2010 Update

To try continue to try and squeeze some more performance out of a retirement investing strategy that is heavily focused on asset allocation I am using a cyclically adjusted PE ratio (known as the PE10 or CAPE) for the ASX 200 to attempt to value the Australian Stock Market. The method used is based on that developed by Yale Professor Robert Shiller for the S&P 500. I will call it the ASX 200 PE10 and it is the ratio of Real (ie after inflation) Monthly Prices and the 10 Year Real (ie after inflation) Average Earnings. For my Australian Equities I will use a nominal ASX 200 PE10 value of 16 to equate to when I hold 21% Australian Equities. On a linear scale I will target 30% less stocks when the ASX 200 PE10 = 26 and will own 30% more stocks when the ASX 200 PE10 = 6.