This post is a response to the brief exchange with Faustus on the last Gold Price in British Pounds post. Today I’d like to attempt to answer the first question which is “whether gold is really as good a hedge against sterling inflation as is sometimes suggested.”

Let’s firstly review why in my opinion it is important not to forget about the damage that inflation can do to your savings. The Bank of England has a remit “to deliver price stability – low inflation – and, subject to that, to support the Government’s economic objectives including those for growth and employment. Price stability is defined by the Government’s inflation target of 2%.” If January 2013 sees the Consumer Price Index (CPI) remain above 2%, and at 2.7% today I see no reason why this won’t be the case, then this will be the thirty eighth month in a row that they have missed their target. This demonstrates that the Bank of England’s remit actually has nothing to do with the official line presented. If it did they would have been made sacked for poor performance long ago. I therefore take inflation seriously.

If you believe that the CPI provides an accurate measure of inflation, and had the Bank of England met their remit of inflation at 2%, then £1 three years ago would have had the purchasing power of £0.94 today. Instead the current policy employed by the Bank of England, of keeping the patient flat lined at 0.5% combined with plenty of QE, means that your £1 actually only buys £0.90 worth of goods and services today. That’s a 10% loss of purchasing power in only 3 short years.

I’ve already laid out some techniques I’m using to protect myself from inflation however let’s now look if gold could be added to that list for UK Investors.

Pages

▼

Sunday, 27 January 2013

Wednesday, 23 January 2013

UK House Value vs UK House Affordability – January 2013

This is the monthly UK House Affordability update, which is the metric that I believe is the key driver of UK House Prices. It is also the update for UK House Value which is the metric I am using to assess when it is time to buy a UK home. The last update can be found here.

Let’s first update the key data being used to calculate both UK House Value and UK House Affordability:

Unfortunately, the Average Weekly Earnings dataset limits this analysis to January 2000. I however want to look at longer term trends to try and judge where fair value may be and even what P/E lows we could expect going forward. To get an indicator of this I use an older similar dataset which was discontinued by the ONS in September 2010. This was the Seasonally Adjusted Average Earnings Index (AEI) for the Main Industrial Sectors. This dataset goes back to 1990 which is sufficient to take us back through the last UK property bust. I then convert the Average Weekly Earnings dataset to an index and overlay both on the chart below. This shows that today we are still nowhere near fair value.

Let’s first update the key data being used to calculate both UK House Value and UK House Affordability:

- UK Nominal House Prices. In recent posts we have been comparing the different UK House Price Indices however for this analysis we will stay with the Nationwide Historical House Price dataset. December 2013 house prices were reported as £162,262. Month on month that is a fall of £1,591 (-1.0%). Year on year sees a decrease of £1,560 (-0.9%).

- UK Real House Prices. If we account for the devaluation of the £ through inflation (the Retail Prices Index) we see those falls accelerated. Month on month that decrease of £1,591 changes to a decrease of £2,385 (-1.4%). Year on year that £1,560 decrease grows to a decrease £6,625 (-3.9%). In real terms prices are now back to those around December 2002 (from March 2003 last month).

- UK Nominal Earnings. I choose to use the Office for National Statistics (ONS) Average Weekly Earnings KAB9 dataset which is the seasonally adjusted average weekly earnings of both the public and private sector including bonuses. November 2012 sees earnings at £472. Month on month that is an increase of £1. Year on year the increase is £7 (1.5%). With inflation (the Retail Prices Index) running at 3.0% over the same yearly period the purchasing power of those that work continues to be eroded.

- UK Mortgage Rates. The proxy I use to monitor mortgage interest rates is the Bank of England dataset IUMTLMV which is the monthly interest rate of UK resident banks and building societies sterling Standard Variable Rate (SVR) mortgage to households (not seasonally adjusted). December 2012 sees this reach 4.35% which month on month is a tiny uptick of 0.01% and year on year is an increase of 0.23%. We now need to be careful with this dataset and keep an eye on other mortgage types because the new Funding for Lending Scheme (FLS) is now starting to distort the UK mortgage market. I’ll provide full details in a post soon however I will say that 2, 3 and 5 Year Fixed Rate Mortgages are now continuing falling.

UK House Value

The stock market uses the Price to Earnings Ratio (P/E) as a possible valuation metric. I choose to use the same metric to assess housing value and show this in my first chart below. For Price I use Nominal House Prices and for Earnings I use the UK Nominal Earnings multiplied by 52 to convert to Annual Earnings. This shows that today we are sitting on a P/E of 6.6 which down from 6.7 last month. This means property is better value this month than last. While being a long way off the peak value 8.3 we are also still a long way off of the 4.6 seen in January 2000.

Click to enlarge

Click to enlarge

Sunday, 20 January 2013

A Method to Calculate Historic Portfolio Performance

I find that in life if you want to succeed at something you must have a plan. This plan in its most basic form will include a number of goals and a timeline detailing when you intend to meet those goals. Once you have that plan in place you must then track progress against the plan and should you deviate you should put actions in place to get you back on track. Personal Finance is no different.

Within the Invest Wisely portion of my strategy I have two distinct goals for my Low Charge Portfolio. The first is to beat a Benchmark that I have set myself. Everybody’s Benchmark will of course be different. It could be to beat the FTSE100, the FTSE 250, the Barclays UK Government Inflation-Linked Float Adjusted Bond Index, a combination of these or something completely different. Remember when you set your Benchmark you must ensure it has a similar risk profile to your investments and contains investments that are as close to yours as possible. What good is it to spend time developing a Low Charge Portfolio and Strategy if you can’t at least match (for those of us where personal finance is a hobby) or beat a simple Benchmark (for those of us where personal finance is a hobby or chore). If we can’t meet this goal then we’re probably better off just buying a Vanguard LifeStrategy Fund.

The second aim is for my portfolio to over the long term meet or exceed a Real Total Return goal that I have set myself. This is defined as over the course of my investing career the sum of the capital gains within my portfolio and the dividends paid must exceed UK Inflation by a specific amount. In the interests of full transparency I must point out that I am current not meeting my goal however by tracking progress I at least know why I am missing and have planned actions to recover.

Let’s look at the method I use to calculate the historic performance of my portfolio assuming I want to look at Total Return. Calculating Real Total Return is then just a simple matter of subtracting your chosen inflation measure from the calculations for the period concerned.

A couple of important points:

Let’s continue with our worked example and now calculate the Personal Rate of Return.

Another important point:

Within the Invest Wisely portion of my strategy I have two distinct goals for my Low Charge Portfolio. The first is to beat a Benchmark that I have set myself. Everybody’s Benchmark will of course be different. It could be to beat the FTSE100, the FTSE 250, the Barclays UK Government Inflation-Linked Float Adjusted Bond Index, a combination of these or something completely different. Remember when you set your Benchmark you must ensure it has a similar risk profile to your investments and contains investments that are as close to yours as possible. What good is it to spend time developing a Low Charge Portfolio and Strategy if you can’t at least match (for those of us where personal finance is a hobby) or beat a simple Benchmark (for those of us where personal finance is a hobby or chore). If we can’t meet this goal then we’re probably better off just buying a Vanguard LifeStrategy Fund.

The second aim is for my portfolio to over the long term meet or exceed a Real Total Return goal that I have set myself. This is defined as over the course of my investing career the sum of the capital gains within my portfolio and the dividends paid must exceed UK Inflation by a specific amount. In the interests of full transparency I must point out that I am current not meeting my goal however by tracking progress I at least know why I am missing and have planned actions to recover.

Let’s look at the method I use to calculate the historic performance of my portfolio assuming I want to look at Total Return. Calculating Real Total Return is then just a simple matter of subtracting your chosen inflation measure from the calculations for the period concerned.

Calculating Year to Date and Yearly Total Portfolio Return

To make this calculation you only need 4 things:- Access to the XIRR function within Microsoft Excel. This function is not typically part of the standard Excel install so if you have Excel and can’t find XIRR you may need to install what is called the Analysis Toolpak. As every version of Excel is slightly different just type “Install Analysis Toolpak” into Excel’s Help and you should get the guidance you need for your version.

- The start date for the period you are interested in analysing and the value of your portfolio on that date. This must be the earliest date entered into Excel.

- The end date for the period you are interested in analysing and the value of your portfolio on that date. When running the calculation this value should be entered as a negative number.

- Any cashflows into or out of your portfolio. Note that because I am calculating Total Return all of my dividends have been reinvested in my portfolio and so I don’t need to include any dividends within the cashflows. Cash into the portfolio should be entered as a positive number and cash out should be entered as a negative number.

Click to enlarge

A couple of important points:

- The first column entry into the XIRR formula is the cashflows, the second column is the dates and the third piece of data you have to enter is a guess as to what the return might be.

- It doesn’t matter what the period you are using is, whether 1 month, 1 year or 10 years, the return will always be an annualised return. So in the example above, which is only a 3 month period, were the year continue at the current rate of return then you’d see a return of 64.7%. You have not achieved a 64.7% return over that 3 month period.

Let’s continue with our worked example and now calculate the Personal Rate of Return.

Click to enlarge

Another important point:

- Note how even though we are looking at a 3 month period the PRR is not equal to the XIRR value divided by 4.

Saturday, 19 January 2013

Investing for Income via Higher Yielding Shares

I’d like to welcome back John Hulton. John claims to not be a financial guru, stockbroker or financial journalist, but just an average bloke who has managed to find a way through the minefields of personal finance and develop a system that works for him and, which could be helpful for other people. He has already retired from full time work which puts him at the end game of what this Site is about – Save Hard, Invest Wisely, Retire Early. The fact that he did this at 55 means his Save Hard, Invest Wisely element worked for him. So while John is not a financial expert his approach has given him what many of us are chasing. I hope you again enjoy his thoughts.

There’s no getting away from the fact that the past 4 or 5 years have been tough for savers and pensioners. The Bank of England has kept interest rates at a record low 0.5% for the fourth consecutive year. Annuity rates are equally at an all time low and there appears little reason to think there will be any significant change for the foreseeable future.

According to a recent study by Prudential, people retiring this year will have a typical yearly income of £15,300, around £3,400 less than those who retired in 2008. In a separate report by Moneyfacts, they found that annuity income fell by 11.5% in 2012, the biggest annual fall since 1998.

Understandably, many savers are looking for alternatives which can provide a better return than the 2% or so on offer from their bank or building society. Likewise, people approaching retirement are investigating alternatives to the rock-bottom annuity rates currently on offer.

One way to maximise income is to invest in a diverse portfolio of large, well-run companies which will grow their earnings and profits for the decades ahead. Companies which have weathered the storm over the past 5 years and have also managed to maintain a steady stream of rising dividends are likely to continue doing this in the future.

In my ebook Slow & Steady Steps from Debt to Wealth I set out a step-by-step guide to generating income from the stockmarket. I have found, through a process of trial and error over several years that a combination of individual higher yield shares together with a portfolio of investment trusts gets the job done for me.

I set out a step-by-step guide to generating income from the stockmarket. I have found, through a process of trial and error over several years that a combination of individual higher yield shares together with a portfolio of investment trusts gets the job done for me.

In a post earlier this month I outlined some of the benefits of investment trusts and in this second part, I will cover my higher-yield shares portfolio.

For me, the main advantage of holding individual shares is lower ongoing costs - after the initial purchase, which could be as low as £1.50 plus 0.5% stamp duty, there are no further costs involved in holding the portfolio. I suppose if you are in the build phase and reinvesting dividends from time to time in more shares, there will be some further minor cost but basically, once you have purchased your 15 or 20 shares that’s it. With investment trusts there are the same initial costs to purchase PLUS the trusts annual expenses and management fees - usually between 0.5% and 1% (plus any performance fee).

There’s no getting away from the fact that the past 4 or 5 years have been tough for savers and pensioners. The Bank of England has kept interest rates at a record low 0.5% for the fourth consecutive year. Annuity rates are equally at an all time low and there appears little reason to think there will be any significant change for the foreseeable future.

According to a recent study by Prudential, people retiring this year will have a typical yearly income of £15,300, around £3,400 less than those who retired in 2008. In a separate report by Moneyfacts, they found that annuity income fell by 11.5% in 2012, the biggest annual fall since 1998.

Understandably, many savers are looking for alternatives which can provide a better return than the 2% or so on offer from their bank or building society. Likewise, people approaching retirement are investigating alternatives to the rock-bottom annuity rates currently on offer.

One way to maximise income is to invest in a diverse portfolio of large, well-run companies which will grow their earnings and profits for the decades ahead. Companies which have weathered the storm over the past 5 years and have also managed to maintain a steady stream of rising dividends are likely to continue doing this in the future.

In my ebook Slow & Steady Steps from Debt to Wealth

In a post earlier this month I outlined some of the benefits of investment trusts and in this second part, I will cover my higher-yield shares portfolio.

For me, the main advantage of holding individual shares is lower ongoing costs - after the initial purchase, which could be as low as £1.50 plus 0.5% stamp duty, there are no further costs involved in holding the portfolio. I suppose if you are in the build phase and reinvesting dividends from time to time in more shares, there will be some further minor cost but basically, once you have purchased your 15 or 20 shares that’s it. With investment trusts there are the same initial costs to purchase PLUS the trusts annual expenses and management fees - usually between 0.5% and 1% (plus any performance fee).

Wednesday, 16 January 2013

The FTSE 100 Cyclically Adjusted PE Ratio (FTSE 100 CAPE or PE10) – January 2013 Update

This is the Retirement Investing Today monthly update for the FTSE 100 Cyclically Adjusted PE (FTSE 100 CAPE). Last month’s update can be found here.

As always before we look at the CAPE let us first look at other key FTSE 100 metrics:

The first chart below provides a historic view of the Real (CPI adjusted) FTSE 100 Price and the Real FTSE 100 P/E. Look at the trend line of the Real Price. After you strip out the effects of inflation the perceived market value is doing not much more than oscillating above and below a flat line. This then presents a problem for any buy and holder reinforcing the importance of dividends. The second chart provides a historic view of the Real Earnings along with a rolling Real 10 Year Earnings Average for the FTSE 100.

As always let us now turn our attention to the FTSE 100 Cyclically Adjusted PE. This is also shown in the first chart above. For completeness let me also detail the usual reminders. I do not use P/E ratio’s to make investment decisions from and instead use this CAPE. This is because the P/E ratio does not take the business cycle into account which the CAPE tries to adjust for. The method used is similar to that developed by Professor Robert Shiller for the S&P500. The calculation is the ratio of Real (ie after inflation) FTSE 100 first possible day of the month Price to the 10 Year Real (CPI adjusted) first possible day of the month Earnings. Unfortunately the dataset I have created only goes back to July 1993. Therefore to get a meaningful set of numbers I have had to average in to a PE10 for the first 10 years. What this means is that July 1994 is actually a PE1, July 1995 is a PE2 and so forth until July 2003 when we have a full FTSE 100 PE10.

As always before we look at the CAPE let us first look at other key FTSE 100 metrics:

- The FTSE 100 Price is currently 6,104 which is a gain of 4.0% on the 03 December 2012 Price of 5,871 and 7.1% above the 02 January 2012 Price of 5,700.

- The FTSE 100 Dividend Yield is currently 3.64% which is a little down against the 03 December 2013 yield of 3.73%.

- The FTSE 100 Price to Earnings (P/E) Ratio is currently 11.78.

- The Price and the P/E Ratio allows us to calculate the FTSE 100 As Reported Earnings (which are the last reported year’s earnings and are made up of the sum of the latest two half years earnings) as 518. They are up 1.1% month on month but down 6.5% year on year. The Earnings Yield is therefore 8.5%.

The first chart below provides a historic view of the Real (CPI adjusted) FTSE 100 Price and the Real FTSE 100 P/E. Look at the trend line of the Real Price. After you strip out the effects of inflation the perceived market value is doing not much more than oscillating above and below a flat line. This then presents a problem for any buy and holder reinforcing the importance of dividends. The second chart provides a historic view of the Real Earnings along with a rolling Real 10 Year Earnings Average for the FTSE 100.

Click to enlarge

Click to enlarge

As always let us now turn our attention to the FTSE 100 Cyclically Adjusted PE. This is also shown in the first chart above. For completeness let me also detail the usual reminders. I do not use P/E ratio’s to make investment decisions from and instead use this CAPE. This is because the P/E ratio does not take the business cycle into account which the CAPE tries to adjust for. The method used is similar to that developed by Professor Robert Shiller for the S&P500. The calculation is the ratio of Real (ie after inflation) FTSE 100 first possible day of the month Price to the 10 Year Real (CPI adjusted) first possible day of the month Earnings. Unfortunately the dataset I have created only goes back to July 1993. Therefore to get a meaningful set of numbers I have had to average in to a PE10 for the first 10 years. What this means is that July 1994 is actually a PE1, July 1995 is a PE2 and so forth until July 2003 when we have a full FTSE 100 PE10.

Sunday, 13 January 2013

The ASX 200 Cyclically Adjusted PE (aka ASX 200 PE10 or ASX200 CAPE) – January 2013 Update

This is the Retirement Investing Today monthly update for the Australian ASX 200 Cyclically Adjusted PE (ASX 200 CAPE). The last update can be found here.

Before we run the CAPE analysis let us first look at some of the key Australian Stock Market metrics:

The first chart today shows a historic view of the Real (inflation adjusted) ASX 200 Price and the ASX 200 P/E. The second chart provides a historic view of the Real (after inflation) Earnings and the Real (after inflation) Dividends for the ASX 200.

Before we run the CAPE analysis let us first look at some of the key Australian Stock Market metrics:

- The ASX 200 Price at market close on Friday was 4,709 which is up 1.3% from last month’s Price of 4,649 and up 10.5% year on year.

- The MSCI Australia Dividend Yield is currently 4.6%. I accept this Index as an ASX200 proxy for both Dividend Yield and P/E Ratio based on this analysis.

- The ASX 200 Earnings (calculated using MSCI Australia P/E Ratio and ASX 200 Price) are currently 304. This gives an Earnings Yield of 6.5%.

- The MSCI Australia P/E Ratio is currently 15.5 compared with the dataset (since December 1982) average P/E of 18.3

The first chart today shows a historic view of the Real (inflation adjusted) ASX 200 Price and the ASX 200 P/E. The second chart provides a historic view of the Real (after inflation) Earnings and the Real (after inflation) Dividends for the ASX 200.

Click to enlarge

Click to enlarge

Saturday, 12 January 2013

A Retirement Investing Today Review of 2012

This is a belated 2012 review of my own personal situation. It comes a little later than most personal finance bloggers for 2 main reasons:

My personal investing strategy is now aligned around the mantra – Save Hard, Invest Wisely, Retire Early so let’s review my year around those 6 short words.

My aim is to regularly save 60% of my earnings. Earnings I define as my gross (ie before tax) earnings plus any employee pension contributions. When the year is rolled up I actually missed my target with a result of 55% of earnings being saved. So where did the money go:

Year end score: Conceded Pass. The amount saved was nowhere enough for Early Retirement Extreme however it should still be plenty for a nice Early Retirement. My plan for next year is to get that savings rate back up to 60%.

I have continued with the Retirement Investing Today Low Charge Strategy. My asset allocations at year end are shown in the chart below.

I have continued to invest as tax efficiently as possible. At year end 69.1% of the total portfolio is invested this way with the distribution being:

- A portion of my exposure to Australian Equities is held with Vanguard Investments Australia in the form of the Vanguard Index Australian Shares Fund. This fund distributes income on the 31 December and so it takes a few days for the distribution to be declared and the unit price to adjust. I can’t close out my year until this occurs.

- I monitor the value of the Retirement Investing Today Low Charge Portfolio on a weekly basis rolling up the values every Saturday. This means for me my year actually started at the market close on the 06 January 2012 and finished on the market close on the 04 January 2013.

My personal investing strategy is now aligned around the mantra – Save Hard, Invest Wisely, Retire Early so let’s review my year around those 6 short words.

Save Hard

My aim is to regularly save 60% of my earnings. Earnings I define as my gross (ie before tax) earnings plus any employee pension contributions. When the year is rolled up I actually missed my target with a result of 55% of earnings being saved. So where did the money go:

- 32% was invested into Pension Wrappers

- 18% was invested into ISA’s, NS&I Index Linked Savings Certificates and non tax efficient locations

- 5% was used by my better half to ensure both our early retirement ambitions stay in sync. Therefore this money didn’t make it into my Invest Wisely but are still family savings so I’ve chosen to include them.

Year end score: Conceded Pass. The amount saved was nowhere enough for Early Retirement Extreme however it should still be plenty for a nice Early Retirement. My plan for next year is to get that savings rate back up to 60%.

Invest Wisely

I have continued with the Retirement Investing Today Low Charge Strategy. My asset allocations at year end are shown in the chart below.

Click to enlarge

I have continued to invest as tax efficiently as possible. At year end 69.1% of the total portfolio is invested this way with the distribution being:

- 39.2% held within Pension Wrappers with the majority being within a Sippdeal SIPP

- 17.3% held within NS&I Index Linked Savings Certificates

- 12.6% held within ISA Wrappers. 100% of which is invested within the TD Trading ISA. I continue to use TD Direct Investing as the Investments I hold within the ISA, plus the fact that I have over £5,100 with TD means I have no annual fees to pay. This helps ensure I minimise fees and taxes and not just taxes.

Wednesday, 9 January 2013

The S&P 500 Cyclically Adjusted PE (aka S&P 500 or Shiller PE10 or CAPE) – January 2013 Update

This is the Retirement Investing Today monthly update for the S&P500 Cyclically Adjusted PE (S&P 500 CAPE). Last month’s update can be found here.

As usual before we look at the CAPE let us first look at other key S&P 500 metrics:

The first chart below provides a historic view of the Real (inflation adjusted) S&P 500 Price and the S&P 500 P/E. The second chart below provides a historic view of the Real (after inflation) Earnings and Real (after inflation) Dividends for the S&P 500.

As always let us now turn our attention to the metric that this post is interested in which is the Shiller PE10. This is also shown in the first chart which dates back to 1881 and is effectively an S&P 500 cyclically adjusted PE or CAPE for short. This method is used and was made famous by Professor Robert Shiller. It is simply the ratio of Real (ie after inflation) S&P 500 Monthly Prices to 10 Year Real (ie after inflation) Average Earnings.

It is important to highlight that my calculation method varies from that of Professor Shiller. He only uses S&P 500 Actual Earnings data where because I use the S&P 500 PE10 to actually make investment decisions from I also include extrapolated Earnings estimates right up to the present day. This is to try and make the value as current as possible.

As usual before we look at the CAPE let us first look at other key S&P 500 metrics:

- The S&P 500 Price is currently 1,461 which is a rise of 2.7% on last month’s Price of 1,422 and 12.3% above this time last year’s monthly Price of 1,301.

- The S&P 500 Dividend Yield is currently 2.1%.

- The S&P As Reported Earnings (using a combination of actual and estimated earnings) are currently $87.55 for an Earnings Yield of 6.0%.

- The S&P 500 P/E Ratio is currently 16.7 which is up from last month’s 16.3.

The first chart below provides a historic view of the Real (inflation adjusted) S&P 500 Price and the S&P 500 P/E. The second chart below provides a historic view of the Real (after inflation) Earnings and Real (after inflation) Dividends for the S&P 500.

Click to enlarge

Click to enlarge

As always let us now turn our attention to the metric that this post is interested in which is the Shiller PE10. This is also shown in the first chart which dates back to 1881 and is effectively an S&P 500 cyclically adjusted PE or CAPE for short. This method is used and was made famous by Professor Robert Shiller. It is simply the ratio of Real (ie after inflation) S&P 500 Monthly Prices to 10 Year Real (ie after inflation) Average Earnings.

It is important to highlight that my calculation method varies from that of Professor Shiller. He only uses S&P 500 Actual Earnings data where because I use the S&P 500 PE10 to actually make investment decisions from I also include extrapolated Earnings estimates right up to the present day. This is to try and make the value as current as possible.

Monday, 7 January 2013

Posting the Quarterly Roundup on Monevator (Again)

There is no post today as I’m guest posting over on Monevator what is now a regular quarterly feature – The Monevator Private Investor Market Roundup. The Roundup reviews various global markets over the last quarter and is in my usual non-emotional (well not too much emotion) fact based analysis and today covers equities, UK housing and commodities. Some of the content is unique to the Roundup and is not available on Retirement Investing Today.

If this is of interest (and you are not a regular reader of Monevator) here is the link to The Monevator Private Investor Market Roundup for January 2013. ( ) While you’re there you might want to subscribe to Monevator via email, RSS, Twitter or Facebook as the team over there really do make a lot of sense.

As always it would be great to hear your thoughts.

If this is of interest (and you are not a regular reader of Monevator) here is the link to The Monevator Private Investor Market Roundup for January 2013. ( ) While you’re there you might want to subscribe to Monevator via email, RSS, Twitter or Facebook as the team over there really do make a lot of sense.

As always it would be great to hear your thoughts.

Sunday, 6 January 2013

Gold Priced in British Pounds (GBP or £’s) – January 2013 Update

This is the regular Gold Priced in Pound Sterling update. The last update was in December 2012.

The chart below shows the Nominal Monthly Gold Price since 1979. The key Nominal Gold metrics are:

The chart below then adjusts this chart by the continual devaluation of Sterling through inflation. The key Real Monthly Gold Price metrics are:

The chart below shows the Nominal Monthly Gold Price since 1979. The key Nominal Gold metrics are:

- The Nominal Gold Price is currently £1,030.03 which is 1.3% below the December 2012 Price of £1,044.09.

- Year on Year Nominal Gold Prices are 3.5% below the January 2012 Price of £1,067.76.

Click to enlarge

The chart below then adjusts this chart by the continual devaluation of Sterling through inflation. The key Real Monthly Gold Price metrics are:

- Real Gold Peak Price was £1,176.61 in January 1980. At £1,030.03 we are 12.5% below that peak today.

- The long run average is £528.29 which is indicating a very large 95% potential overvaluation.

- The trendline indicates the Real Gold Price should today be £478 which would indicate even further overvaluation today.

Click to enlarge

Saturday, 5 January 2013

The Fiscal Cliff and Severe Real S&P500 Bear Markets – January 2013 Update

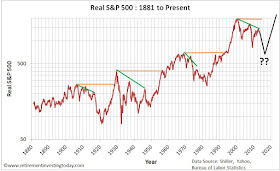

With the US Government this week deciding that it was going to make no attempt to at least start the country along the road towards living within its means, the so called Fiscal Cliff was avoided. In response the S&P500 rose 4.0% in the week to close at 1,466. While the main stream media were getting all excited about this increase I started to think about how this continual kicking of the can down the road could actually be storing up future problems, which might actually prolong the Severe Real S&P500 Bear Market I believe we may still find ourselves within. I last posted about this analysis in September 2012. As a reminder I define a Severe S&P500 Bear Market as a period in time where from the stock market reaching a new Real (inflation adjusted) high it then proceeded to lose in excess of 60% of its real Value.

The previous Severe Real S&P500 Bear Markets are revealed in the chart below which corrects historic S&P500 Prices since 1881 by the devaluation of the US Dollar to arrive at Real Prices. This chart shows we are now back to Prices last seen in March 1998 and also shows we have seen three previous Severe Real Bear Markets.

If I think of the US Government putting off this unpopular decision for another day then at some time in the future the bond market may force them to make a decision. Of course at that time they will then have somebody else to blame which will suit the weak politicians whose only focus seems to be to get themselves re-elected. The subsequent rise in taxes and cuts to spending which would then follow would then have to be worse than they were faced with today because through indecision they have made the problem a larger one to solve. The S&P 500 may then respond with a big fall which brings me back to the chart above. Now there is of course a risk that I’ve been looking at this chart too long however I can generally see in the last 3 Severe Bear Markets two lower Real highs following the initial new Real high. From this second lower Real high we then see Real Prices fall between 40 and 60%. Are we are nearing that second lower high and could this government indecision actually end up causing this next big leg down? Of course I would never buy or sell based on this hypothesis because the market can remain irrational far longer than I can remain solvent.

If I overlay the three Severe S&P Bear Markets with today’s market by comparing the percentage change in value from the peak for each of these periods we arrive at today’s second chart. So what were these previous bear markets?

The previous Severe Real S&P500 Bear Markets are revealed in the chart below which corrects historic S&P500 Prices since 1881 by the devaluation of the US Dollar to arrive at Real Prices. This chart shows we are now back to Prices last seen in March 1998 and also shows we have seen three previous Severe Real Bear Markets.

Click to enlarge

If I think of the US Government putting off this unpopular decision for another day then at some time in the future the bond market may force them to make a decision. Of course at that time they will then have somebody else to blame which will suit the weak politicians whose only focus seems to be to get themselves re-elected. The subsequent rise in taxes and cuts to spending which would then follow would then have to be worse than they were faced with today because through indecision they have made the problem a larger one to solve. The S&P 500 may then respond with a big fall which brings me back to the chart above. Now there is of course a risk that I’ve been looking at this chart too long however I can generally see in the last 3 Severe Bear Markets two lower Real highs following the initial new Real high. From this second lower Real high we then see Real Prices fall between 40 and 60%. Are we are nearing that second lower high and could this government indecision actually end up causing this next big leg down? Of course I would never buy or sell based on this hypothesis because the market can remain irrational far longer than I can remain solvent.

If I overlay the three Severe S&P Bear Markets with today’s market by comparing the percentage change in value from the peak for each of these periods we arrive at today’s second chart. So what were these previous bear markets?

Click to enlarge

Wednesday, 2 January 2013

Investing for Income via Investment Trusts

I’m very pleased to introduce a post from Retirement Investing Today reader John Hulton. John claims to not be a financial guru, stockbroker or financial journalist, but just an average bloke who has managed to find a way through the minefields of personal finance, develop a system that works for him and which could be helpful for other people. He has already retired from full time work at the age of 55 and as he is now financially secure can afford to relax, spend more time pursuing his hobbies, managing his investments and pension. Or in short a perfect match for what this website is all about. I hope you enjoy his thoughts.

In my ebook Slow & Steady Steps from Debt to Wealth I set out a step-by-step guide to generating income from the stockmarket. I have found, through a process of trial and error over several years, that a combination of individual higher yield shares together with a portfolio of investment trusts gets the job done for me.

I set out a step-by-step guide to generating income from the stockmarket. I have found, through a process of trial and error over several years, that a combination of individual higher yield shares together with a portfolio of investment trusts gets the job done for me.

In this post I will outline some of the benefits of investment trusts and at a later date, return to my shares portfolio.

I currently hold a core portfolio of 12 trusts which have been gradually built up over the past few years. They have been mainly purchased during periods of market downturns. The most recent buying spree was May 2012 when I purchased Invesco Income, Edinburgh, Temple Bar, Aberforth Smaller and topped up City of London and Murray International.

The mainstay of my portfolio is selected from the UK Income & Growth sector, however I like a well diversified range of investment trusts and include international orientated trusts as well as smaller companies and corporate bonds. Average return this past year including dividends was 21%. The column headed ‘Revenue Reserves’ gives some indication of the number of months the trust could continue to pay dividends even if the trust received no further income.

Bearing in mind the total return from the FTSE 100 was around 10%, I am more than pleased with this year’s returns. Dividends have increased this year by an average of 5%. I suspect all managers are maintaining some degree of caution and therefore retaining income within the trusts as increases on my individual shares portfolio have increased around 11% this year. The main thing for me is whether the portfolio delivers sustainable dividend increases which are above inflation each year.

At the time of writing this article the FTSE has climbed above 6,000 (last seen in July 2011) and as you can see, the total return on my investment trusts have increased over 20% so I would certainly be a little more cautious if I were starting today. There may well be more favourable opportunities over the coming year when the markets turn down and yields improve.

Of course, over the longer term, market timing is not so important but it will obviously be a little disappointing to pile in with your lump sum and see the value of your portfolio drop 10% or even 20% over the next few months. In a rising market it is better to drip feed money into the market gradually. My online broker Sippdeal has the option of regular investing for just £1.50 per trade which means you can economically invest sums of say £250 per month whilst waiting for better opportunities down the line. You could easily use my portfolio above as a template portfolio of say £12,000 and as the basis for starting your research. A common theme with all 12 holdings is that they have excellent long term performance records relative to their benchmarks and, by and large, managers who have been in place for some time. For example, Job Curtis at City of London has been manager since 1991 (shortly after I started investing). The trust has a record of increasing dividends in each of the past 46 years.

There are many investment trusts which could just as well do the same job or better - these are the ones I have researched. I do not advocate lazily copying these trusts (however tempting) as it is an important step, in my opinion, to do your own research and take responsibility for your selections and decisions.

A good starting point of reference for research is The Association of Investment Companies and also Trustnet.

In my ebook Slow & Steady Steps from Debt to Wealth

In this post I will outline some of the benefits of investment trusts and at a later date, return to my shares portfolio.

I currently hold a core portfolio of 12 trusts which have been gradually built up over the past few years. They have been mainly purchased during periods of market downturns. The most recent buying spree was May 2012 when I purchased Invesco Income, Edinburgh, Temple Bar, Aberforth Smaller and topped up City of London and Murray International.

The mainstay of my portfolio is selected from the UK Income & Growth sector, however I like a well diversified range of investment trusts and include international orientated trusts as well as smaller companies and corporate bonds. Average return this past year including dividends was 21%. The column headed ‘Revenue Reserves’ gives some indication of the number of months the trust could continue to pay dividends even if the trust received no further income.

Click to enlarge

Bearing in mind the total return from the FTSE 100 was around 10%, I am more than pleased with this year’s returns. Dividends have increased this year by an average of 5%. I suspect all managers are maintaining some degree of caution and therefore retaining income within the trusts as increases on my individual shares portfolio have increased around 11% this year. The main thing for me is whether the portfolio delivers sustainable dividend increases which are above inflation each year.

How to start a portfolio

As with any portfolio, your aims should be to get the right balance between risk and reward, to be clear about what you want to achieve and over what time span, and then to adopt the right approach when the portfolio is fully invested. Do lots of research around the trusts which are most likely to achieve your goals and, of course, take it slow & steady.At the time of writing this article the FTSE has climbed above 6,000 (last seen in July 2011) and as you can see, the total return on my investment trusts have increased over 20% so I would certainly be a little more cautious if I were starting today. There may well be more favourable opportunities over the coming year when the markets turn down and yields improve.

Of course, over the longer term, market timing is not so important but it will obviously be a little disappointing to pile in with your lump sum and see the value of your portfolio drop 10% or even 20% over the next few months. In a rising market it is better to drip feed money into the market gradually. My online broker Sippdeal has the option of regular investing for just £1.50 per trade which means you can economically invest sums of say £250 per month whilst waiting for better opportunities down the line. You could easily use my portfolio above as a template portfolio of say £12,000 and as the basis for starting your research. A common theme with all 12 holdings is that they have excellent long term performance records relative to their benchmarks and, by and large, managers who have been in place for some time. For example, Job Curtis at City of London has been manager since 1991 (shortly after I started investing). The trust has a record of increasing dividends in each of the past 46 years.

There are many investment trusts which could just as well do the same job or better - these are the ones I have researched. I do not advocate lazily copying these trusts (however tempting) as it is an important step, in my opinion, to do your own research and take responsibility for your selections and decisions.

A good starting point of reference for research is The Association of Investment Companies and also Trustnet.

UK Savings Account Interest Rates – January 2013 Update

Since 2009 UK savers have seen big falls in the interest rates being paid by the top savings accounts. For a short time there was a little light at the end of the tunnel however this looks to have likely been removed with the Government / Bank of England’s introduction of the Funding for Lending Scheme (FLS).

Money Saving Expert tells us that if you are in the market for an easy access savings account you can get a savings interest rate of 2.35% AER. Forget to switch at the end of 12 months to the bank offering the highest interest rate at that time and that becomes 1.35%. Back in June 2012 you could get 3.2% AER variable with Santander reducing to 0.5% after 12 months. That’s a fall of 0.85% in only 6 months.

If you choose to go for a no nonsense easy access savings account (always my preferred option), again using Money Saving Expert, that interest rate today is 2.3% AER with West Bromwich Building Society (as long you have a balance over £1,000 and only make 1 withdrawal a year). Back in June 2012 the best rate was 2.75% AER variable with Aldermore (again, as long you had a balance over £1,000). That’s a fall of 0.45% in 6 months.

Why do I think the Funding for lending Scheme has caused at least some, if not all of this? Banks can now get cheap loans directly from the Bank of England to fund Business and Mortgage loans. The more they borrow from the Bank of England they cheaper those loans become. Why then borrow from the average punter. They don’t need us anymore. Well at least for the next 18 months.

What’s worse is that the easy access savings accounts detailed above are the best accounts out there. My chart today shows what is happening to the average account.

Money Saving Expert tells us that if you are in the market for an easy access savings account you can get a savings interest rate of 2.35% AER. Forget to switch at the end of 12 months to the bank offering the highest interest rate at that time and that becomes 1.35%. Back in June 2012 you could get 3.2% AER variable with Santander reducing to 0.5% after 12 months. That’s a fall of 0.85% in only 6 months.

If you choose to go for a no nonsense easy access savings account (always my preferred option), again using Money Saving Expert, that interest rate today is 2.3% AER with West Bromwich Building Society (as long you have a balance over £1,000 and only make 1 withdrawal a year). Back in June 2012 the best rate was 2.75% AER variable with Aldermore (again, as long you had a balance over £1,000). That’s a fall of 0.45% in 6 months.

Why do I think the Funding for lending Scheme has caused at least some, if not all of this? Banks can now get cheap loans directly from the Bank of England to fund Business and Mortgage loans. The more they borrow from the Bank of England they cheaper those loans become. Why then borrow from the average punter. They don’t need us anymore. Well at least for the next 18 months.

What’s worse is that the easy access savings accounts detailed above are the best accounts out there. My chart today shows what is happening to the average account.

Click to enlarge

Tuesday, 1 January 2013

UK Mortgage Interest Rates – January 2013 Update

Analysis shows that today the purchase of a UK house through a mortgage is affordable however at the same time UK house prices are not good value. This appears to be a surreal situation which is brought about by the abnormally low mortgage interest rates that are currently on offer today. It is now my belief that we won’t see fairly valued housing in the UK until mortgages rates return to some semblance of normality. With that in mind I’m starting a new dataset focused entirely on UK mortgage rates which will enable us to watch the mortgage market. This might give us a heads up on what might be about to happen to house prices.

The Bank of England publishes a number of datasets on this topic and I have picked 5 which cover the more common mortgage types available today. They are the sterling monthly mortgage interest rate of UK monetary financial institutions (excluding Central Bank) covering:

A zoomed version of this mortgage chart is shown below. I’ve also placed the announcement dates of some of the well known market manipulations that have been undertaken by the UK Government and Bank of England which have helped keep rates mortgage rates low. These include a Bank of England Bank Rate of 0.5%, 4 tranches of Quantitative Easing and the Funding for Lending Scheme (FLS). So what is happening to mortgage rates? Standard Variable and Lifetime Trackers are getting more expensive and are up 0.01% and 0.04% month on month respectively. Year on year they are up 0.22% and 0.38%.

The Bank of England publishes a number of datasets on this topic and I have picked 5 which cover the more common mortgage types available today. They are the sterling monthly mortgage interest rate of UK monetary financial institutions (excluding Central Bank) covering:

- Standard Variable Rate (SVR) mortgages

- Lifetime Tracker mortgages

- 2, 3 and 5 Year Fixed Rate Mortgages with a 75% loan to value ratio (LTV)

Click to enlarge

A zoomed version of this mortgage chart is shown below. I’ve also placed the announcement dates of some of the well known market manipulations that have been undertaken by the UK Government and Bank of England which have helped keep rates mortgage rates low. These include a Bank of England Bank Rate of 0.5%, 4 tranches of Quantitative Easing and the Funding for Lending Scheme (FLS). So what is happening to mortgage rates? Standard Variable and Lifetime Trackers are getting more expensive and are up 0.01% and 0.04% month on month respectively. Year on year they are up 0.22% and 0.38%.

Click to enlarge