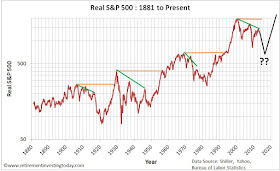

The previous Severe Real S&P500 Bear Markets are revealed in the chart below which corrects historic S&P500 Prices since 1881 by the devaluation of the US Dollar to arrive at Real Prices. This chart shows we are now back to Prices last seen in March 1998 and also shows we have seen three previous Severe Real Bear Markets.

Click to enlarge

If I think of the US Government putting off this unpopular decision for another day then at some time in the future the bond market may force them to make a decision. Of course at that time they will then have somebody else to blame which will suit the weak politicians whose only focus seems to be to get themselves re-elected. The subsequent rise in taxes and cuts to spending which would then follow would then have to be worse than they were faced with today because through indecision they have made the problem a larger one to solve. The S&P 500 may then respond with a big fall which brings me back to the chart above. Now there is of course a risk that I’ve been looking at this chart too long however I can generally see in the last 3 Severe Bear Markets two lower Real highs following the initial new Real high. From this second lower Real high we then see Real Prices fall between 40 and 60%. Are we are nearing that second lower high and could this government indecision actually end up causing this next big leg down? Of course I would never buy or sell based on this hypothesis because the market can remain irrational far longer than I can remain solvent.

If I overlay the three Severe S&P Bear Markets with today’s market by comparing the percentage change in value from the peak for each of these periods we arrive at today’s second chart. So what were these previous bear markets?

Click to enlarge

The first severe stock bear market (marked in purple on the chart) started with a new real (inflation adjusted) high being reached in September 1906. Following this high the market then began declining with the period incorporating the 1907 Bankers Panic which was caused by banks retracting market liquidity and depositors losing confidence in the banks. This occurred during a recession and there were a number of runs on banks and trust companies. Additionally, many state and local banks went bankrupt. From the high it took until January 1920 for the stock market to break through the 60% real loss barrier (a real loss of 60.9%) and then until December 1920 to reach its real low of -70.0%. That’s 171 months a period of 14 years and 3 months. The market then didn’t reach a new real high until September 1928, which is exactly 22 years, at which point it was rising at a rate of 25% year on year. Unfortunately though, the market had less than 2 more years of positive real returns in it before hitting the next severe stock market.

This second severe stock bear (marked in blue on the chart) market started with a new real high being reached in September 1929. This is the beginnings of the well known period of the Great Depression. I won’t go into the history here as I’m sure it’s well known by all readers. What is interesting however is that the US stock market passed through the -60% mark on a number of occasions. From the high it took until January 1931 for the stock market to reach a real loss below the magic 60% mark at -62.0% and then until June 1932 to reach its real low of -80.6%. The rate of decline was much faster than severe stock bear market one at 33 months. However at this point the market never really recovered and dipped back below the real -60% mark in January 1933, July 1934, April 1938, June 1940, February 1941 and was back at -73.1% in May 1942. That’s a period of 152 months or 12 years and 8 months. Even 20 years later the market was still below the real -60% mark. This bear market didn’t actually reach a new high until November 1958 which is a period of more than 29 years. Again at this point the market was on a steep ascent rising at a rate of 27% year on year.

The third severe stock bear (marked in olive on the chart) market started with a new real high being reached in December 1968. This period incorporated the stock market crash of 1973 to 1974 which came after the collapse of the Bretton Woods system and also incorporated the 1973 Oil Crisis. So from the high it took until March 1982 for the stock market to reach a real loss of -60.9% and then until July 1982 to reach its real low of -62.6%. That’s a period of 13 years and 7 months. A new high wasn’t reached until December 1992 which is a period of 24 years.

So that brings me back to today’s market which I show as the last line on my second chart, marked in red, showing the market we have been in since August 2000. It started with the Dot Com Crash however we were unable to reach a new real high before the Global Financial Crisis took hold and we entered what has been called the Great Recession. Since then we have recovered to be 25.2% down from the 2000 Real high. The good news is that I can’t yet call this period a Severe Bear Market as we ‘only’ reached -58.6% in March 2009. The bad news is that we are only 148 months into this one, which if history is any guide, leaves us plenty of time yet to see a Severe Stock Bear market. What will cause it? There are many possibilities which might include the US Government indecision I described above, Quantitative Easing leading to big inflation or a large country going bankrupt. As always, I don’t claim to have any idea. All I know is history suggests there is still plenty of time for it to occur.

As always DYOR.

Assumptions include:

- Inflation data from the Bureau of Labor Statistics. December 2012 and January 2013 inflation is extrapolated.

- Prices are month averages except January 2013 which is the S&P 500 closing price on the 04 January 2013.

Food for thought, as always, RIT. I know I don't comment very much, but I always enjoy your work.

ReplyDeleteHi SG

DeleteThanks for the support. You haven't posted for over 2 months now - maybe time for an update (even if it's a brief one)?

Cheers

RIT

I think you have a technical point here - it is entirely possible that the market could fall dramatically, especially if earnings growth is limited. On the other hand, the fundamental economic analysis here is all wrong. How can a country be living beyond its means when there is massive unemployment? What do you mean by live beyond their means, anyway? Import goods?

ReplyDeleteThe bond market can't force the US government to do anything, because the US government has total control of the bond market and the means by which they can control it - quantitative easing - does not cause inflation.

Finally, it isn't possible for a large nation such as the US to be made bankrupt - though they could make he mad decision of refusing to respect their debts.

Hi Anonymous

DeleteThanks for putting a different viewpoint on the topic.

In my opinion a country is living beyond its means if it has more value entering its borders than leaving it. This will cause it to run a deficit which someday must be repaid or defaulted on (whether by a hard default or inflation).

I don't know if QE will cause inflation or not. Only time will tell. I do have a thought on QE however.

The US debt is something like $16.3 trillion. The Fed has QE'd about $2.8 trillion of that resulting in the low bond rates we see today. So about 17% of the total debt with plenty still to buy today. The question is as this % grows at what point will the 1st non Fed bond holder start to think that Quantitative Easing must eventually lead to bond prices falling with the Fed unable to do anything about it and so decide to sell?

Here’s my rationale. Scenario 1. If the Fed don't continue to buy then a (the?) main buyer is out of the market which free market economics then suggest will result in prices falling and rates rising. Scenario 2. So the Fed continue to buy but then at some point surely the markets realise the QE is so large that the debt will never be able to be sold back to the market and so will be the equivalent of real money printing, devaluing the currency in the process, resulting in massive bond selling, pushing prices down and interest rates up.

Either way $ debt interest rates rise. This leaves the government with the choice to print more to pay the bills (there's your inflation) or to default.

Too wild a story?

Cheers

RIT

Imports are foreigners saving - resulting in either a private or public sector deficit - this is true. We are getting stuff now, we might have to pay for it in the future, but I just can't bring myself to be too excited about this - we certainly won't be paying more than we can.

ReplyDeleteAnd, I don't think a government debt does have to be repaid, at least not in full - it can be continually rolled over. If we look back at history, the government debt has existed for hundreds of years - and some suggest that attempts to reduce it have always resulted in recession.

Why would the US government choose to pay higher interest rates rather than simply buying the bonds?

"Scenario 2. So the Fed continue to buy but then at some point surely the markets realise the QE is so large that the debt will never be able to be sold back to the market and so will be the equivalent of real money printing, devaluing the currency in the process, resulting in massive bond selling, pushing prices down and interest rates up."

There can't be inflation unless people have money, wages need to be rising first. At the moment there seems to be zero political will to allow that to happen. Simple panic will not lead to inflation unless people have money to spend - we'll either need an economic recovery first or a desire for pay rises despite stagnation.

Which is actually beside the point, because if the US government decides to maintain the price of bonds (which it can do given unlimited funds), interest bearing bonds will allways beat non-interest cash. So why would you sell?

The point I'm trying to make here isn't that bonds are a good investment - but the US government doesn't have to make any decisions based upon what the bond market will do and that therefore a higher government debt doesn't indicate higher interest rates or taxes in the future, except to the extent that the economy recovers and the government chooses these policies. But if the economy has recovered, presumably that would be good for stocks...