“Financial independence is generally used to describe the state of having sufficient personal wealth to live, without having to work actively for basic necessities. For financially independent people, their assets generate income that is greater than their expenses.”

3,186 days ago I started on a journey to early Retirement which at the time I defined as work becoming optional. Only later did I discover that the more appropriate terminology for what I was chasing was FIRE – financially independent and retired early. Every week since that journey started I’ve sat down and updated my financial position and progress to FIRE. Today this stared back at me:

Click to enlarge, Path trodden towards financial independence

One of these is the risk that my State Pension might not be triple locked or at least increased with inflation. Now in my financial planning I’ve never assumed I’d be entitled but I’d always planned on continuing to pay in voluntarily as my insurance policy against financial Armageddon. Now that insurance policy might be almost worthless as we all know the damage that inflation can inflict. A second is the risk that at State Pension age I won’t be entitled to the same public healthcare as a local in my new adopted EU country courtesy of UK PLC. This might mean private healthcare into our dotage but what if we do fall into poor health and our chosen private provider decides we’re no longer profitable enough for them.

At the other end of the scale we’ve seen the government of one of my potential homes, Cyprus, reduce Immovable Property Tax (IPT), which is the equivalent of Council Tax, by 75% in 2016 with a plan to then subsequently abolish it in 2017. This is a country with so much debt that the Troika stepped in to bail them out only a few short years ago and now they’re cutting taxes by 75% or more. Sure it plays into my hands for now but it’s not much good if it leads to bust and closed cash points later.

So in light of all of this what right do I actually have to call myself financially independent? Below is my justification.

The RIT household could today get on a plane destined for the Mediterranean and once Immigration had been cleared could at current exchange rates use some of my £1,014,000 to buy this (even though we’ll actually rent for at least 6 months):

Click to enlarge, Detached, 3 bedroom, 120 sqm home in Paphos, Cyprus

Which comes with one of these:

Click to enlarge, I can see myself in there on a weekday summer evening

And which has views like this:

Click to enlarge, Yes those are sea views

Ignoring any house price negotiation I’d most certainly be up for and after purchase costs my wealth would quickly be down to £799,000. For some time now I’ve been saying I will create an annual income from my wealth by drawing down at 2.5%. After this research, this research and this modelling I’m still happy with that rate. That gives me £19,973 per annum to live a luxurious lifestyle. Is it possible?

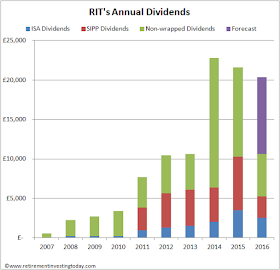

I’ve always said that my plan was to try and live off the dividends of my portfolio in FIRE. In 2016 I should bring in £20,382 worth of dividends. On top of that I can add £1,921 worth of dividends that will come from again transferring my expensive insurance company based work pension with its accumulation funds into a low cost SIPP where I’ll buy low cost OEIC’s or ETF’s. So I’ll be spending 90% of the dividends I earn and reinvesting the rest. I’m ok with that.

Click to enlarge, £20,382 worth of dividends expected in 2016

I now need to run the home I’ve just bought. I’ve assumed repairs will run to 1% of the home value. On top of that I’ll need electricity, heating where I’ve assumed an open fire for 4 months of the year (after all this is to be a luxurious FIRE), water and home/contents insurance. I’ll also have IPT and local authority fees. I estimate that lot will cost me EUR5,139 per annum so my EUR22,429 just became EUR17,291.

A car will be a complete luxury, but hey why not, we want the freedom to live outside of the main towns and to travel at will. I’m assuming I buy a new (even if I actually will probably buy second hand) small hatchback and write its value off completely over 10 years which is conservative. I’ll then need to insure it, get some breakdown cover for it, tax it, occasionally change tyres/service it and buy some fuel for it which will be for fun only rather than commuting. My car habit should cost me EUR2,304 per annum leaving me with EUR14,987.

Click to enlarge, A small hatchback will be more than adequate

Even pre-government tinkering I’ve known we’ll need to pay for healthcare up until State Pension age. One positive is that in my planning I’ve always assumed I’ll be paying for it forever so post-Brexit changes don’t concern me greatly financially. Where I do still have risk is if a private company decides in our dotage to stop covering us or puts the prices to such an extreme that they are saying they don’t want to cover us and we can’t get coverage elsewhere. The way I look at this is that worst case we end up in another Med country where we can buy public healthcare or even in an extreme end up back in the UK. If we don’t go we stay in the UK and if we do go we might end up back in the UK but will have many years of happy memories living our dream. I think I’m ok with that.

On top of healthcare we’ll also pay voluntary Class 3 National Insurance (NI) contributions, to build 35 years worth, which should make us eligible for a full State Pensions. Once we have enough that money will then be available for increased healthcare premiums which will occur as we age. Best case is we get the pension which will be 100% bonus unplanned spending, neutral case is it remains ‘inflation linked’ so we keep our insurance policy and worst case is it loses its ‘inflation linking’. Again, it will only ever actually be required if my portfolio blows up for some reason and so very worst case is we live off the State Pension in the Med until it’s value is eroded too severely by inflation. After that we end up back in the UK to see out our time. Life could be worse.

Healthcare and NI contributions are planned to run to EUR3,868 per annum leaving me with earnings of EUR11,119.

Food wise we currently eat very well. I’m assuming we keep eating well. On top of that we will also need to communicate with the outside world so will need internet and a mobile phone. That all takes another EUR4,128 leaving EUR6,991.

So I have EUR6,991 per annum leftover for fun, holidays, personal effect like clothes and one off’s. That is far more than I spend today and also only has to cover my costs. On top of that my better half has her savings/investments which will fund her fun/holiday/etc costs and her fun pot is larger than mine. So now back to what if the £ collapses post Brexit? If I was to cut my discretionary spending by a third I could cope with an exchange rate at parity forever. If I was then to allow the home to degrade over time (and what old persons home doesn’t) and not replace bathrooms, kitchen etc but still replace things like boilers it could get to as low as 0.95 and I’d still be ok.

My plan has me buying a luxurious home, with a pool and sea views, that is far bigger and affluent than I have ever lived in. It allows me to continually buy new cars. We have money to stay healthy both by eating well and by ensuring we have adequate health insurance. I have more discretionary spending money than I’ve ever had in my life. I can also cope with a GBP to EUR exchange rate down to 0.95 and still live a very happy life as my tastes are inexpensive. Finally, the worst case seems to be that we end up back in the UK if political turmoil combined with financial Armageddon occurs. I think I’ve earned the right to call myself Financially Independent or FI based on that.

Now what about getting on with it and moving forward with the Retired Early (RE) bit I hear you ask? My problem here is that I just never expected to reach FI so quickly. To put it in perspective year to date my wealth is up some £160,000! Even just back in late May I was saying it would take me 6 months at least to reach the point of FIRE. I’ve now made some commitments which mean we won’t actually be able to be in the Med until late spring/early summer 2017. The negative to this is that I have to keep working at a job that is becoming tougher and tougher. The positive is that if Mr Market just performs to average between saving and investing I could add another £150,000 to my wealth over that time. That truly gives me options – a more posh home, a smarter car, more travel or probably the most likely just more wealth for the same spending which buys me even more withdrawal rate or exchange rate protection. Is it one more year syndrome (OMY)? I don’t think so. More pleasantly surprised syndrome from somebody who IMHO built a plan that has just worked.

As always DYOR.

well a congratulations is certainly in order!

ReplyDeleteyou only need work an extra year or two and you can retire in real style, lovely classic car.

Hopefully not two! I'm not sure my body and mind would take it...

DeleteThanks for the wishes.

RIT,

ReplyDeleteCongratulations! Earlier arrival also means an extra buffer that can be compounded.

Just one query on the figures. Net after the house at 799k sterling seems high. I thought the house was 350k Euros so costs 291k sterling

That was always the plan but having reflected on it over the past few weeks I just don't think we'll need to spend that much. There are homes available for a lot less than EUR350k that will be palaces for us. I was just being greedy and flippant in hindsight. It just might mean waiting for it a little which is ok as we'll rent first anyway.

DeleteBy not maxing out the home it then gives opportunity for more contingency elsewhere as we've been discussing recently and as hopefully I've shown today. Later in the summer we're heading to our likely destination for a few weeks and staying away from the tourists to double check we've picked the right location. As part of that we'll be looking at houses both for sale and rent. If I have it wrong and we have to up our budget then that's doable in the time between FI and RE. While it's doable it's absolutely not essential as we can easily fulfil our plans and dreams with a lot less.

Many thanks for the congrats and the great discussion in recent times.

I'm conscious that over the years and throughout the blog posts my story has changed. This in hindsight is because (in addition to the changes because of mechanical learning) this blog for me this has been about a real life journey rather than a commercial pre-prepared script like most websites. It's been one where I have learnt so much about saving/investing but in doing so have learnt just what is important for me and my family.

DeleteWe've come to the conclusion that stuff and keeping up with the Jones's just doesn't do it for us which of course then gives us a big advantage financially.

RIT,

DeleteOne idea has just struck me but you may not approve of it. As your pot is now going to be higher, by 100k+, you could use that extra buffer to buy a small house or flat in the UK. Then let it out to go towards your rent in the Med and living costs once you have bought there. It gives you a UK bolthole, residency options inc health, tax/ISA's etc. The other option is that before renting abroad, you could use it as a base to explore more places a abroad, without having rent to pay here.

You may see it as added complications instead of options but it was just a thought.

Thanks for the thoughts and I'm sure it's just me but I personally have a bit of a problem with BTL in the UK:

Delete- Some level of BTL is a good thing as it does enable mobility (it's certainly worked for me) but I think it's now made it to the point where with all the cheap credit floating around it's actually pricing those who want to buy out of the market. Recent government changes like Clause 24 will hopefully redress the balance a bit but given the tough planning laws in this country I really don't want to go to sleep at night knowing I'm preventing a family from owning a home.

- I don't want the maintenance problem. The last thing I want is someone deciding to stop paying the rent and then having to go through the hassle of evicting them. Then on the way out they take the copper pipe out of the walls.

- I want to cut ties with the UK from a HMRC perspective and definitely do not want a UK domicile going forwards. That leaves me open to all sorts of UK taxation possibilities that might be dreamt up in the years going forward.

Instead I want to eventually sever all ties with the UK, adopt my new country and then hope with time that they eventually adopt me.

RIT,

DeletePart of my thinking was that you have previously said you wanted to have the option to return to the UK, if the Med didn't work out. The bolthole would be insurance for that. Since posting earlier, I've also wondered if Scotland might be the place to buy a bolthole. If we did Brexit but they remained property there might help, plus if university tuition fees are on the the horizon, they are free there. I can understand your anti-BTL sentiments though so maybe not.

You're right that I do want the option but I think timelines are the difference in our thinking. I want a path back to the UK until I'm sure the Med is for us. I'm guessing we'll 'know' within the first year or so. If it works then I'll slowly transition to a European investor I expect. A BTL would I expect be a much longer investment time frame.

DeleteScotland is one very beautiful country. One year during my more spendy days I actually did a 'loop' during the winter and then one during the summer. The contrast was amazing. Seriously considered the Highlands as a FIRE location but the winters look brutal to me. Then thought about a home in Scotland for the summer and a bolthole in the winter sun for EUR50k or so but it's the duplicate costs that start to add up plus the UK Council Tax costs for what seems a bin emptying service require huge wealth to support. The final thing that stopped me thinking that way was spirit of community. Would anywhere actually feel like home and would you ever become part of the community.

RIT,

DeleteI wasn't thinking of the BTL as very long term but the more I've thought about it since, for someone with children it appeals more. If a Scottish one could be used for some initial income, free tuition fees and rent free while at Uni, it seems to be self funded. Maybe the Scottish thing is not that easy.

Your ideal scenario is obviously to hit the right Med spot straight away, without renting in different places. Try acclimatise to FIRE and spend more time on holiday, testing places out of season!

While on my journey to build my FIRE funds I've tried to spend time, including time out of tourist season, in each of our preferred locations. Ideally we do hit our spot straight away but I'm not going to be too disappointed if we don't. The pressure really is off and we have the whole of our lives to find the right spot. That said I am conscious that continual moving is disruptive and not without cost.

DeleteWell done RIT, all the hard work & sacrifice is now coming good. What a wonderful position to be in.

ReplyDeleteA bit more of a margin of safety is comforting I suppose, but your numbers seem good.. as someone said none of us are getting out of here alive.

As you will have a small surplus to invest, and you don't sell any assets, you'll surely far outpace inflation anyway.. It will be interesting to watch developments :-) Nick

Many thanks for the support Nick. It's finally starting to sink in and to top it all off it's an absolutely glorious day outside.

DeleteCongratulations RIT! You are an inspiration.

ReplyDeleteThanks for the wishes Elef.

DeleteI suppose that this is not the ideal time to recommend Turkish North Cyprus as a destination for your lurk abroad.

ReplyDeleteIf Greece exited the Euro could there be an option? Their currency would depreciate initially making property much cheaper for foreigners. Their wages would have to be lower to be competitive and that's what makes living costs cheaper and where income from capital lasts longer.

DeleteHave people living in the TRNC even noticed is probably the more relevant (and hopefully correct) question. I really do hope that normal people just trying to go about their lives are not hurt or affected by this. I wouldn't wish it on anyone.

DeleteGreece. Another absolutely beautiful country. One of the best holidays of my life was spent on a Greek island eating some fabulous inexpensive fresh food.

Happy independence day! It's a wonderful moment to witness and fills me with hope and inspiration. Love the pictures of the potential new residence. Looks gorgeous.

ReplyDeleteDo you think work will become less stressful because you now know you can walk out at any time?

My own research has led me to conclude that flexibility is key to a successful retirement rather than the fidelity of forecasting. It seems to me you have plenty of buffer to deal with a wide range of possible outcomes short of the apocalypse. For contrast, I'm aiming for circa £20K per year for two!

Thanks TA. TBH I am so tempted to just go now. To try and motivate myself I have a small countdown timer that counts down the weeks now to FIRE - it includes time to resign and time to leave. Will see if I last. I'm not sure if it will become less stressful as part of the problem is the responsibility of the job which has to be done well or people can be badly affected. It will however allow me to speak very freely which will be interesting...

DeleteAgree with you on the flexibility. I have plenty of discretionary spending in the budget so that shouldn't be too difficult.

Re the £20K. I did run a spending model for the UK and I came to £20,103 (plus better half fun money) plus a paid for home. That did however include 2x Class 3 NI contributions within it and plenty (probably too much) fun money. To put it in perspective for all of 2015 ex work/rent I spent £7,400 so £20k sounds like plenty of opportunity for fun also.

Being able to speak freely may have unintended and unexpected consequences... like promotion!

DeleteCongratulations and well done on your FI, RIT! Looking at your photos of your Mediterranean pad, I'd be so tempted to chuck it all in right now!

ReplyDeleteThanks for the congratulations weenie. Day 2 is already feeling better than day 1. You're right about chucking it in now. I know the right thing to do is go when I've planned but it is tempting.

DeleteWell done RIT. Coincidentally last Thursday was my last day at work and I plan to live off dividends. I'm based in SE, have kids at school so no plans to relocate. I think decompression will take a few months. Decluttering and simplifying everything is first task. Studied engineering and always loved Maths, plan is to teach Maths to adults and see what happens. Its an exciting time to be free as a bird !

ReplyDeleteRegards, Jon

Many congratulations Jon. Are you 100% FIRE now and the maths teaching is just a financially unnecessary but fun side hustle? That is exactly what I planned on when I started out - work becoming optional.

DeleteI'm obviously not into decompression yet but from what I've read it can take a while. I plan to make no permanent life changing decisions for at least 6 months once I do finally FIRE. I'm not quite sure who I am at the moment with work being such a big part of life. I want to find that out first.

I am pretty confident that residency rules would stop you from living abroad, but sending your kids here for a free education (at least I hope they would). There's something incredibly depressing about someone suggesting that a FI millionaire game the system for a free education for their kids, can't see how that would sit with RIT's commitment to some sense of fairness (see comments re. BTL etc.)

ReplyDeleteSorry I depressed you but the whole point of FIRE is someone is trying to exit the system. This is partly done by saving. The fact that 1m isn't worth what it was is due to the system, so I have no scruples about making a saving by beating it. I'm afraid it's a dog eat dog world now.

DeleteI'd also be hesitant to regard it as "freeloading" or anything like that, as presumably Mr RIT has paid more than a fair share of UK tax on his income over the years. A little harsh maybe? (Not that RIT said he's going to actually go ahead and do that, just speaking hypothetically of course)

DeleteIt's quite an achievement: congratulations.

ReplyDeleteDon't worry too much about the £/€ exchange rate: you'll far outlive the Euro, and probably the EU. Even the pound sterling won't last forever.

There is a risk that in moving to the Med you are moving to a war zone, but you must know that already.

Thanks for the wishes dearieme. As you know I'm a pretty risk averse kind of person and even I'm not thinking about the risk of my soon to be Mediterranean home becoming a war zone.

DeleteHi RIT, yes I'm 100% FIRE. I need to stay mentally alert so the Maths teaching is definitely going to help. I will need to gain some basic teaching qualifications. Right now, I'm taking it easy, I've got all the time in the world to figure it all out. First few months I'm just gonna declutter and simplify everything in my life from clothes to finances but will start with a long family vacation and a period of reflection. Something inside me tells me I may earn even more eventually in the FIRE state because I can choose and take risks. Regards, Jon

ReplyDeleteThanks for coming back there Jon. I wish you the very best during your decompression and your no rush approach sounds very much how I'm going to handle it. I wish you much success as you embark on your new journey.

DeleteSomething I've been wondering about my own future situation, and perhaps you can share your thoughts - you've tipped over the FI point early due to market rises and £ depreciation. What happens if in another few months the moves are reversed and you end up back under your FI figure of £1m? If still working at that point, do you continue until things improve, or are any moves from now on seen just as market randomness which will happen anyway throughout your retirement?

ReplyDeleteThe withdrawal rate I have chosen is designed to be 'safe' providing the worst sequence of returns of the future does not exceed those of the past. The past includes the Great Depression, the 1970's inflation, the dot com crash, the GFC etc. Maybe Brexit is the next big financial event... So if I end up back under the FIRE target it's all ok from here in theory.

DeleteNow of course if tomorrow I was still FI, hadn't RE'd, the pound collapsed and the stock markets of the world halved I would very likely push on a little longer. If not just to hoover up some bargains on sale.

Congratulations! Out of curiosity, why have you plumped for Cyprus and not, say, Malta, or a sunny part of France, Spain or Portugal? Everywhere has their plusses and minuses.

ReplyDeleteThanks Willy. As I mentioned a few weeks ago we still have 3 countries in the mix. We'll make our final decision later in the year when we complete what is hopefully our last exploratory visit. For now I'll stick to the PF pro's/con's as I see them.

DeleteMalta:

- Can access public healthcare via social security contributions (SSC's) so low risk as we age but potentially most expensive given my situation. This would also allow me to build a Malta State Pension meaning UK Class 3 NI contributions wouldn't be required.

- Homes most expensive.

- Mid-range tax of the three.

- Could easily live well without a car offsetting some of those higher costs but have budgeted for one just in case.

- May be able to play some SSC and tax tunes by taking advantage of the non-domicile rules. If we pick Malta will pay for some advice to confirm what I think might be possible.

Spain:

- After first year when will need private can access public healthcare via the convenio especial. Does increase in price once hit age 65 though.

- Homes good value.

- Most expensive tax wise, will lose circa 20%.

- Would expect to need a car to get the type of home we want.

Cyprus:

- Will need private health insurance possible forever as highlighted in the post. Carries risks as highlighted also.

- Homes good value.

- Inexpensive IPT and should get tax on 'earnings' very close to, if not, 0% for first 17 years by using the non-domicile rules.

- Would expect to need a car to get the type of home we want.

Unfortunately France and Portugal just doesn't fit culturally according to our experience. Maybe we were in the wrong areas but they just never felt like they could become home.

Ahha, you've clearly thought everything through. Hope you continue to post, now you have achieved the first part of your goal.

DeleteStill have to get to RE without OMY syndrome setting in yet :-) Then have to decompress and actually settle into retirement. So definitely plenty of posts still to come.

DeleteI've been at this blog now since 2009 and it's just started to get fun and interesting...

RIT, I lived in Malta for a year and half. You will need a car over there. It is worth noting all the natives have a car and usually more than one per family.

DeleteRIT, many, many congratulations - you have been so disciplined and dogged, you are a shining light for us all and thanks for all your careful exposition.

ReplyDeleteYou might just find you need a bit longer to decompress than you expect, so just hang loose and start to enjoy the sun as well as smell the coffee!

Congratulations on FI, I've enjoyed your journey. Out of curiosity, would your number have changed if you didn't have a better half? You mention she's funding her own fun, but does she also contribute to living costs, healthcare etc? Could a single man move in next door for the same pot?

ReplyDeleteCongratulations RIT, steely determination results in a job well done.

ReplyDeleteTwo pence worth:

1) Decompress slowly. Rapid decompressions are not pretty.

2) Don't sit on your arse for 40 years! Use that giant brain of yours for something socially useful, whatever that means.

3) Learn to play the guitar.

John

Nah, the piano. Why waste one hand defining the notes?

DeleteIn my case I'm tempted by the clarinet, which has the advantage that I couldn't sing along.

Hi RIT,

ReplyDeleteMany congratulations - I can only imagine what this must feel like for you! As you replies show through the comments, you have done a huge amount of research and stress testing through it all which will pay off for you to be comfortable.

Its great to see someone hit their numbers, and look at your chart against where I am, sadly I will be somewhat older than you are now by the time I hit FI, but then I am also aware that it is very much my choice because of my lifestyle, and what my spend is :)

Enjoy!

London Rob

Many, many congrats. I've been a bit of a lurker here because our situations are pretty similar - age, networth, etc. The only difference is I'm planning on getting out of London to a lower cost area of the UK rather than abroad. So it's great to hear it's all come together for you - I'm still nervous about my withdrawal rate covering every eventuality (and whether I can overcome my longing for a boat!) so for now I continue to work myself to the bone and accumulate.

ReplyDeleteBest of luck and I hope you continue to blog as your adventure unfolds.

Wow. Well done! Hopefully, you will keep us posted. :)

ReplyDeleteYou and your family will be living by the sea - in a country that can be very hot for long spells.

ReplyDeleteHopefully you and your family enjoy ( or will enjoy ) swimming , diving , snorkelling (? scuba as well ) , sailing , windsurfing , kitesurfing and water skiing .

Activities and sports are such great ways to meet people and settle in to a place - your children should help with that, if you can indulge their interests and tempt them with some of the things that will be on offer. After school clubs , activities ,camps and courses away from home - meeting the parents of your children's friends and contacts.

Also - what about getting a dog ? - having a pet is another great way to meet people in a new place when you are out on walks. And bicycles will be a must have too.

You are going to be busy -in your new playground.

I have never lived in a particularly hot place - but have had some holidays which have been thermically challenged . In my experience the following features make living in a hot climate a bit easier and more comfortable : large airy rooms with high ceilings , consider a single storey building so you have access to the outside from every room ( potentially ) and also don't have the problem of the upstairs being 5'C hotter than downstairs, and you will benefit from lots of outdoor space next to the house - patios, raised decks ( to allow the air to flow underneath) terrace, verandah etc - so you can sit outside in the cooler air and breeze but in the shade as well as out in full sun - and NB you need to have some of these features on each side of the house espec S,E and West. That will also fill your house with light.

120 sq.m of internal area on 2 floors does not sound like it will be very comfortable in an 8 week continuous spell of hot weather. You may find you will need a lot of air conditioning ( which can be noisy )

Congratulations - I hope your family are as excited about their new prospects as you are. The very best of luck to you all.

Don't do it mate. Its not enough, seriously. You have good earnings make the most of them, add another 500K / 3 years whichever comes first and then do it.

ReplyDeleteI'm tempted to agree: aim for £1M over-and-above the price of a house. Though maybe that's the spurious attraction of big, round numbers.

DeleteWe've lived in a hot, dry Mediterranean climate: there was no need for air con. Ceiling fans were enough to let us sleep.

ReplyDeleteYou do have to learn the art of managing thermal gain: windows open overnight with perhaps fans used to suck in cool air (which is best done by having fans pointing outwards through the lee-side windows); once outside is hotter than inside during the day, windows closed and curtains drawn. Lots of insulation in the loft. Good overhang on the roof to keep the walls in shade. You don't want large window areas pointing E, S or W: or you need effective shutters and canopies. The closer you are to sea breezes, the better. Essential to have a shady spot to park the car in. Outdoor cooking area essential.

Friends had the habit of sleeping downstairs in the hottest summer weeks, and sleeping upstairs the rest of the time. Cold showers as required. Need plenty of fridge capacity.

Now if you get hot humid weather you really do want air con.

Dear RIT,

ReplyDeleteI have some knowledge and association with people who have sold up and retired (back) to the Caribbean. If there is one regret that they tend to have, it is that they failed to maintain a base in the UK. While I agree with you about the immorality of the whole BTL scene, I think that you (for your family's sake) should maintain a base in the UK.

Also, you are proposing to set up in a (comparatively) volatile part of the world. How would you respond to a Black Swan event such as Turkey imploding (as so nearly happened the other day), perhaps resulting in ISIS simply taking over Cypress! Even if they subsequently got turfed out, the fighting could destroy the place.

Boring old England does have its benefits.

Yours with thanks,

EHB

"the immorality of the whole BTL scene": oh do lay off. What "immorality"?

ReplyDeleteWell played RIT.

ReplyDeleteFantastic- congratulations RIT. Good job!

ReplyDeleteCongratulations RIT, excellent news.

ReplyDeleteNice one - congratulations on an inspiring finale.

ReplyDeleteTake your time over that decompression, months to a year plus. You become a different person without the stress of working, and it takes time for that to settle in.

Hearty congratulations RIT.

ReplyDeleteLike a Lottery winner who can't quite believe everything has changed and decides to go back to their mundane job the next day - because it provides a framework, meaning and friendships in their lives, I forecast that 'freedom' will change you not one jot. What you have won is not what you thought you might be saving for (retirement and a move to Europe), but actually it is that nebulous concept, 'freedom', itself. It tastes wonderful and forms a confident backdrop to your life. It doesn't mean you have to change anything immediately. If you are happy, it would be fool who thought it would be a good idea to risk change.

Those dividends look glorious, congrats RIT!

ReplyDeleteHappy FI day RIT!

ReplyDeleteI was wondering if you ever considered renting indefinitely. Given your huge pot, I am sure you would be able to rent reasonably below your passive income and still be able to roll over the rest. It just gives you more flexibility and options given the current economic and political uncertainty.

Love to hear more about post FI tales and worries. Keep it coming!

Bit late to the party but wanted to say congratulations RIT!

ReplyDeleteLooking forward to seeing how you make your final exit.

Well done RIT. Wishing you all the best on your journey ahead!

ReplyDeleteGreat achievement .. congrats. Being in a similar position myself, I am not clear about one aspect. The dividends you accrue within your SIPP are surely not accessible to you to spend till you are 55 why are you counting them in your overall income from investments ?

ReplyDeleteBy the way if you retire in Cyprus due to the double taxation agreement you can start drawing income from your SIPP (after 55 or 57) and be taxed at 5% regardless of the amount you draw any given year which is crazy good. Cyprus is my most likely destination too!

ReplyDelete