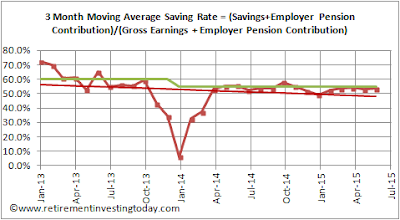

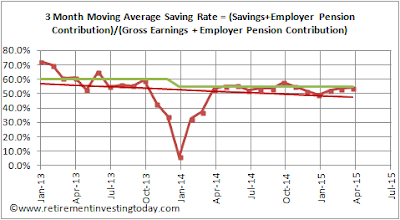

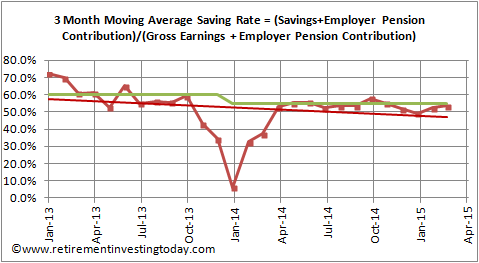

Saving Hard has thus far been one of the biggest contributors to my reasonably rapid FIRE (financially independent retired early) Number progress. For me this has never been about simply spending the least amount possible but instead always about maximising the answer to the formula Earnings – Taxes – Spending. This results in a twofold approach:

With this in mind I suspect my spending profile will look quite strange when compared to many, but hey we’re all different and that’s what makes the world an interesting place.

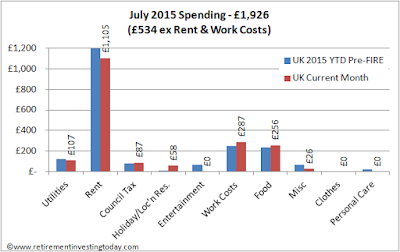

In July 2015 I spent £1,926 (an annualised £23,112) and 2015 Year to Date I've averaged £2,068 per month (£24,816 annualised). This covers all family spending, whether for fun or just too live, plus any personal spending that I desire. The only thing excluded is my better half’s small personal spending. Given this is hopefully my final full year before FIRE I want to track my full 2015 average spending as well as monthly for a couple reasons:

Now the detail:

- Living Well Below Your Means (LWBYM) where that spending has no impact on Earnings; and

- Being prepared to spend where it means Earnings – Taxes – Spending are greater than £0.

With this in mind I suspect my spending profile will look quite strange when compared to many, but hey we’re all different and that’s what makes the world an interesting place.

In July 2015 I spent £1,926 (an annualised £23,112) and 2015 Year to Date I've averaged £2,068 per month (£24,816 annualised). This covers all family spending, whether for fun or just too live, plus any personal spending that I desire. The only thing excluded is my better half’s small personal spending. Given this is hopefully my final full year before FIRE I want to track my full 2015 average spending as well as monthly for a couple reasons:

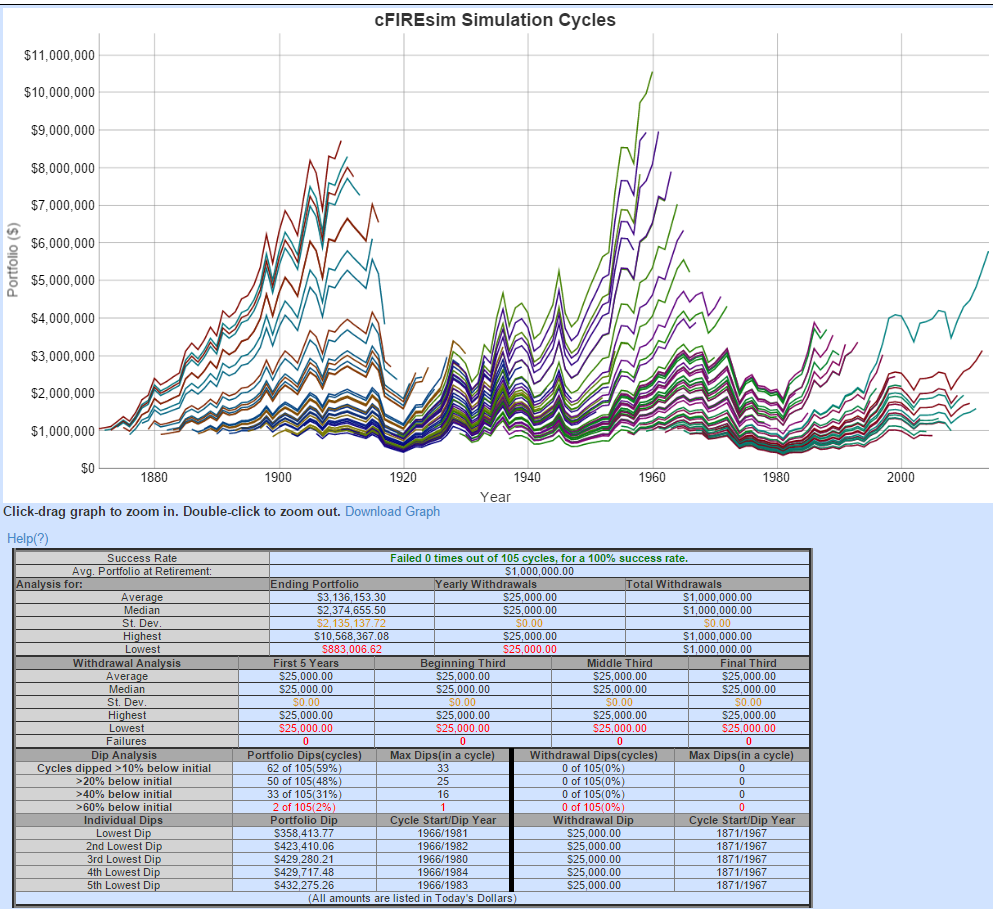

- It gives me a floor of spending at which the family are happy with the lifestyle that we are living. This will help tell me when I’m FI (financial independent), which will be before FIRE’d. It will also help me understand how much overhead my 2.5% wealth withdrawal rate, at the start of FIRE, combined with my £1,000,000, actually provides me with.

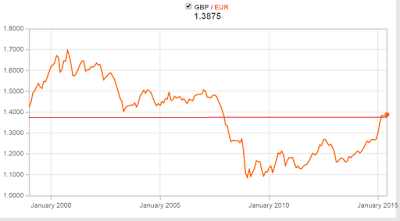

- We are still torn between early retirement in The Mediterranean vs Old Blighty and this will also help us understand our average spending profile when in different countries.

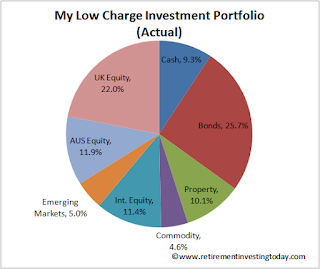

Click to enlarge, Retirement Investing Today July 2015 and Average 2015 Spending

Now the detail: